As a courtesy, we would like to inform you about important cornerstones of the so-called “Blockchain Act,” a summary of which is available online at: https://nlaw.li/tvtges.

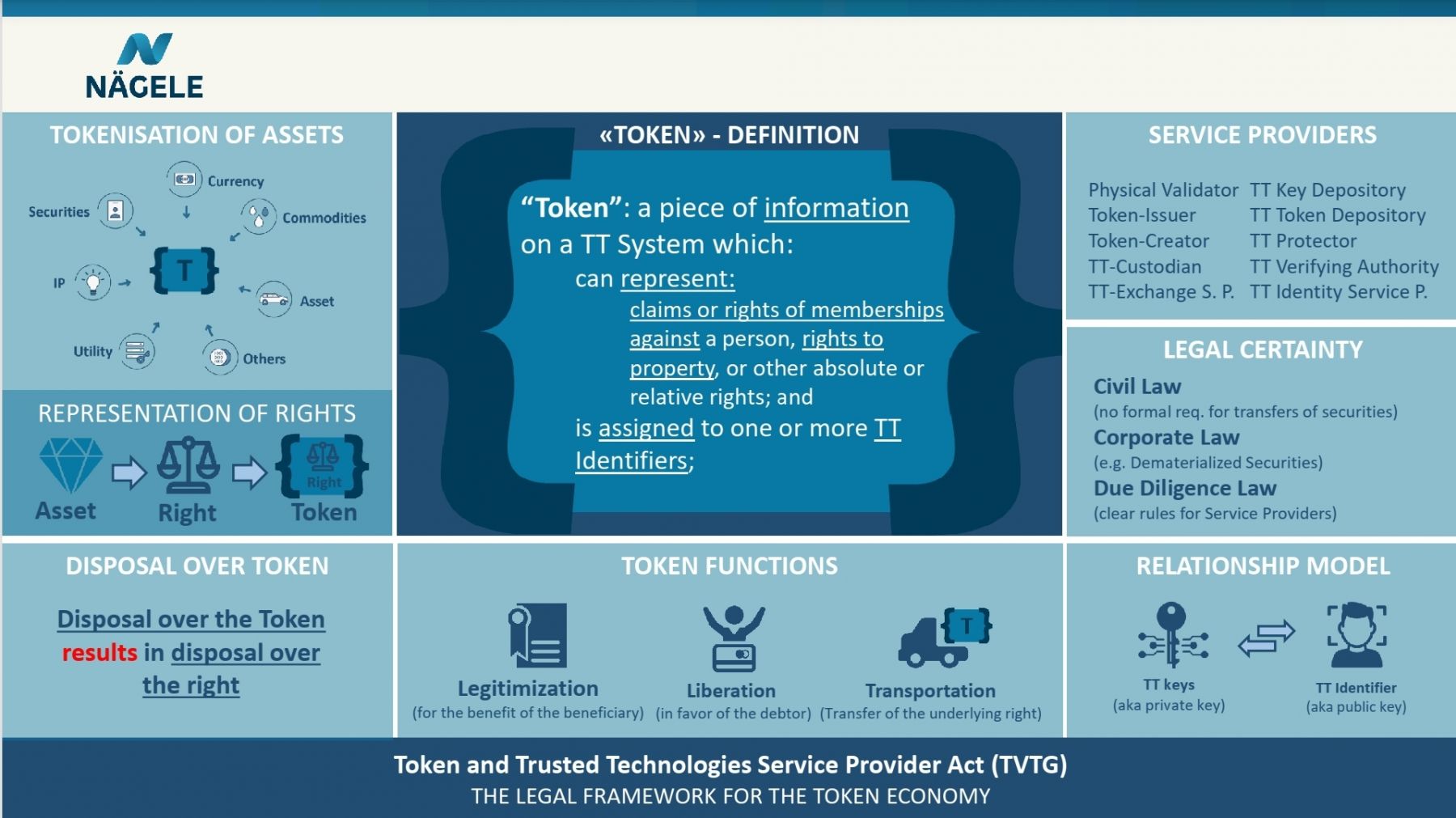

The law on “Tokens and Trusted Technology Service Providers” (TTTL or in German TVTG, LGBI 2019.301; “Blockchain Act”), which will come into force on 01. January 2020, regulates the registration of service providers providing professional services in accordance with the TVTG (TT services). Such service providers must apply with the FMA for registration in the TT Service Provider Register pursuant to Art. 23 TVTG, and are subject to due diligence obligations pursuant to the Due Diligence Act (DDA; SPG) as of 01. January 2020.

In order to determine whether or not the TVTG is applicable to a business model, it is advisable to conduct a legal analysis, which we are happy to carry out if desired. As a non-binding guide as to whether or not the TVTG is relevant, we offer the following flow chart https://nlaw.li/en1. Irrespective of the result of your self-assessment, we recommend obtaining professional legal advice in order to clarify whether or not the TVTG is applicable to your specific business case, advising you to take appropriate precautions with regard to the due diligence processes.

If you are providing services which are covered by the TVTG when it comes into force, it should be noted that business activities are subject to the Liechtenstein due diligence regime as of 01. January, 2020; and, in particular, the corresponding KYC/AML processes must be guaranteed (ensuring identification and prevention of money laundering and terrorist financing by suitable personnel).

Furthermore, we cordially invite you to participate in the Liechtenstein Financial Market Authority’s (FMA) current market study. The survey can be accessed via the following link: https://www.fma-li.li/de/regulierung/fintech-und-tvtg/fintech-marktumfrage.html. Participation is recommended for the following reasons. On the one hand, a representative evaluation can only take place if there is sufficient participation. On the other hand, the FMA’s resources must be expanded if the study shows that there is a need for action in this regard. Therefore, participation would benefit all FinTech companies in Liechtenstein, as it would ensure that the FMA has sufficient qualified personnel and resources available to provide information within a reasonable period of time. Accordingly, we recommend that you participate in this survey on the basis of your own vested interest.

Service providers according to the TVTG:

TT services are defined by Art. 2 para 1. lit i in conjuction with lit k to t TVTG, and include and encompass the services of

TT services, at a glance:

In the following points, the TT service providers and their functions will be summarized in order to facilitate understanding:

Transitional provisions and entry into the TT Services Register:

In accordance with the transitional provisions of Art. 50 para. 1 TVTG, it must be noted that persons who already provide one of the aforementioned TT services before the instatement of the 01. January 2020 registration requirement must comply with this requirement by submitting a written request to the FMA for entry into the TT service Provider’s Register within a period of 12 months of the TVTG’s entry into force (i.e. by 01. January 2021 at the latest). Otherwise, entitlement to the provision to TT services shall lapse. Irrespective of these transitional provisions on registration, the due diligence regime shall be fully applicable by 01. January 2020, provided that TT services are provided. In order to comply with the resulting obligations, the relevant provisions of the DDA and the Due Diligence Ordinance must be observed (suitable personnel, KYC/AML policies, organizational measures, etc.).

With regard to the procedure for registration as a TT service provider, we would like to provide an overview of the details regulated in Articles 13-18 of the TVTG below. An applicant intending to be registered with the FMA as a TT service provider must meet the following criteria:

The registration application addressed to the FMA must contain the following information and documents:

Further information and documents may be required at the request of the FMA.

For the registration of refusal of registration as a TT service provider, the FMA shall charge a fee of CHF 1,500 (Annex 1 Section l.quater lit a of the FMAG (FMA Act in the version LGBl 2019.303). The fee for the issuance of a confirmation of registration is CHF 50.00 (lit f leg cit).

It should be noted that when the TVTG comes into force, business activities must be carried out immediately in accordance with Articles 24 – 38 of the TVTG:

In particular, TT service providers must fulfill the following obligations:

Changes related to due diligence:

With the introduction of the Blockchain Act, the Due Diligence Act will also be amended (SPG as amended by BuA 2019/93). Pursuant to Art. 3 para. 1 lit r and s SPG, new TT service providers subject to registration pursuant to Art. 2 para. 1 lit k and m to q TVTG (Token Issuer, TT key custodian, TT Token Custodian, TT Protector, Physical Validator, TT Exchange Service Provider) as well as domestic token issuers not subject to registration pursuant to Art. 3 para. 1 lit r and s SPG (Due Diligence Act; DDA in the version LGBl 2019.302) are, in the future, new TT service providers subject to registration pursuant to Art. 2 para. 1 lit k and m to q TVTG, as well as domestic token issuers not subject to registration insofar as they carry out transactions amounting to CHF 1,000.00 or more and are to be prepared and staffed by suitable personnel using appropriate KYC and AML concepts. The due diligence obligations shall apply from 01. January 2020 for the provision of corresponding services; and, unlike the registration with the FMA as a TT exchange service provider, no transitional periods shall apply in this respect.

We are happy to examine the applicability of the TVTG and the legal situation amended in accordance with BuA 2019/93 in detail with regard to the facts of the project by means of a separate assignment. In particular, the services of the TT Exchange Service Provider, the TT Token Custodian and, if necessary, also the TT Key Custodian may be considered here - for this we would need further information as to whether you also hold private keys. It should be noted that the Liechtenstein FMA charges fees in the amount of CHF 2,000.00 for information on the applicability of the TVTG or another law listed in Art. 5 (1) FMA (Annex 1 Section l.quater lit h of the FMAG).

Furthermore, we would like to point out that some matters will only be clarified in detail after publication of the TVTV (Token and VT Service Provider Ordinance) and the guidance of the FMA. Additionally, we need a separate order for the concrete assessment and preparation of the registration. In this context, we will not only examine the applicability of the TVTG and the associated changes in the legal situation, but we will also outline the concrete steps to be taken for the application.

If you have any additional questions, please do not hesitate to contact us.

Disclaimer: Art. 6 par. 1 lit. b GDPR provides the basis for the processing of your personal information in order to comply with our contractual and post-contractual duties (obligation to provide information).